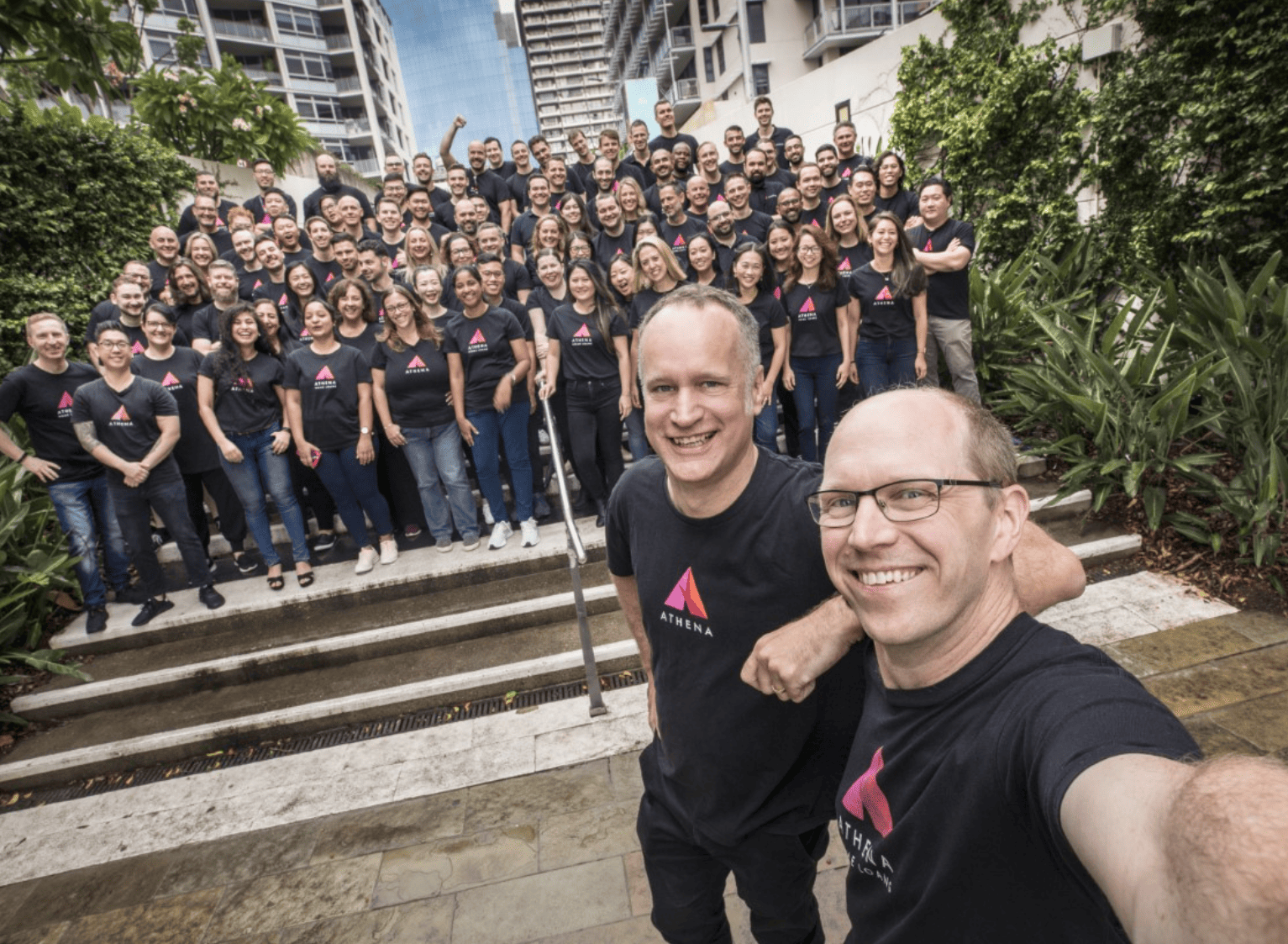

Innovation in financial services is no longer optional—it is essential. As consumer expectations evolve and digital-first experiences become the norm, companies that fail to adapt risk becoming obsolete. Standing at the forefront of this transformation is Athena Home Loans, a challenger brand that has disrupted Australia’s traditionally conservative mortgage market. When the Australian Financial Review (AFR) dubbed Athena Home Loans Australia’s Most Innovative Company, it wasn’t just a headline—it was a validation of how australia startups can redefine entire industries.

Athena Home Loans has emerged as a powerful example of how fintech-led australia startups can combine technology, customer-centric design, and bold thinking to create meaningful change. This article explores Athena’s journey, its innovative business model, its impact on the Australian mortgage ecosystem, and what its success means for the broader australia startups landscape.

The Traditional Mortgage Market: Ripe for Disruption

For decades, Australia’s home loan market was dominated by major banks offering complex products, opaque pricing, and limited incentives for customer loyalty. Borrowers often paid more over time simply because they didn’t refinance, while lenders benefited from “loyalty taxes” imposed on long-term customers.

This inefficiency created fertile ground for disruption—an opportunity that many australia startups identified but few successfully executed at scale. Athena Home Loans, founded in 2017, entered the market with a clear mission: to help Australians pay off their home loans faster by removing unfair pricing and unnecessary complexity.

Unlike traditional banks, Athena was built from the ground up as a digital-first lender, aligning it closely with the innovation ethos driving successful australia startups.

Athena Home Loans: A Challenger with a Clear Purpose

Athena Home Loans was co-founded by seasoned financial services leaders who understood the pain points borrowers faced. Rather than layering innovation on top of outdated systems, Athena took a clean-slate approach—something many australia startups strive for but struggle to achieve in regulated industries.

The company’s purpose was simple yet powerful:

- Eliminate loyalty penalties

- Pass funding cost reductions directly to customers

- Simplify mortgage products

- Use technology to reduce operational inefficiencies

This clarity of purpose allowed Athena to stand out in a crowded fintech space, reinforcing the growing reputation of australia startups as global innovators in financial technology.

What Made Athena AFR’s Most Innovative Company?

The AFR recognition was not based on marketing claims but on measurable innovation. Athena Home Loans demonstrated how strategic thinking, operational efficiency, and customer-first policies could create lasting competitive advantages.

1. Automatic Rate Reductions

One of Athena’s most disruptive innovations is its automatic rate reduction model. When Athena’s cost of funds decreases, those savings are passed directly to existing customers—without requiring renegotiation or refinancing.

This model directly challenges traditional bank practices and has become a defining feature of Athena’s innovation. It is also a benchmark many australia startups now aspire to emulate across industries.

2. No Fees, No Gimmicks

Athena removed application fees, ongoing fees, and exit fees—simplifying the mortgage process significantly. By doing so, it reduced friction, built trust, and attracted digitally savvy borrowers who value transparency.

This philosophy mirrors the broader movement among australia startups, where simplicity and fairness are key drivers of customer acquisition and retention.

3. Cloud-Native Technology Stack

Unlike legacy banks burdened by outdated IT infrastructure, Athena built a modern, cloud-native platform. This enabled:

- Faster loan approvals

- Lower operational costs

- Scalable growth

- Improved data-driven decision-making

Technology-first thinking is a hallmark of successful australia startups, and Athena exemplifies how this approach can thrive even in heavily regulated sectors like finance.

Customer-Centric Innovation at Scale

Athena’s innovation is not limited to pricing or technology—it extends to the entire customer experience.

From online applications to intuitive dashboards and proactive communication, Athena designed its services around real borrower needs. This emphasis on experience has allowed Athena to grow primarily through word-of-mouth, a growth channel commonly leveraged by australia startups that prioritize product excellence over aggressive advertising.

Funding, Growth, and Market Impact

Athena Home Loans has attracted significant institutional backing, enabling it to scale rapidly while maintaining its core values. Its growth trajectory highlights how australia startups can compete with established incumbents by focusing on efficiency rather than sheer size.

As Athena expanded its loan book, it also forced traditional lenders to rethink pricing strategies, indirectly benefiting millions of Australian borrowers. This ripple effect underscores the broader economic value created by high-impact australia startups.

Regulatory Navigation: Innovation Within Constraints

Financial services innovation is complex due to regulatory oversight. Athena’s success lies in its ability to innovate responsibly while maintaining compliance—a balance many australia startups find difficult to strike.

By embedding compliance into its technology and operational workflows, Athena proved that regulation does not have to stifle innovation. Instead, it can serve as a framework within which responsible australia startups can flourish.

Athena’s Role in Australia’s Fintech Ecosystem

Athena Home Loans is now widely regarded as a cornerstone of Australia’s fintech ecosystem. Its success has inspired a new wave of australia startups focused on:

- Consumer-first financial products

- Transparent pricing models

- Automated decision-making

- Ethical business practices

The company’s AFR recognition further elevates Australia’s global reputation as a hub for fintech innovation, strengthening the international credibility of australia startups.

Lessons for Other Australia Startups

Athena’s journey offers valuable insights for founders across sectors:

1. Solve a Real Problem

Athena didn’t chase trends—it solved a genuine market inefficiency. Many australia startups fail by focusing on technology before understanding customer pain points.

2. Align Innovation with Values

Innovation without trust is ineffective. Athena’s commitment to fairness became its strongest differentiator, a lesson relevant to all australia startups.

3. Build for Scale from Day One

By investing early in scalable infrastructure, Athena avoided the technical debt that slows many growing australia startups.

The Broader Impact on Consumers and the Economy

Athena Home Loans has helped reshape consumer expectations around mortgages. Borrowers now demand:

- Transparent pricing

- Digital convenience

- Fair treatment over time

These expectations extend beyond finance, influencing how australia startups in healthcare, logistics, education, and retail design their offerings.

At a macro level, Athena’s success contributes to:

- Increased competition

- Lower borrowing costs

- Greater financial literacy

- Stronger startup ecosystems

The Future of Athena Home Loans

Looking ahead, Athena is well-positioned to expand its product offerings, integrate advanced analytics, and deepen customer engagement. As open banking and AI adoption accelerate, Athena’s technology-first foundation gives it a significant advantage.

More importantly, Athena’s continued success will further validate the global potential of australia startups, encouraging investment, talent attraction, and entrepreneurial ambition across the country.

Conclusion: A Defining Moment for Australia Startups

Athena Home Loans being dubbed Australia’s Most Innovative Company by AFR marks more than an individual achievement—it represents a milestone for the entire australia startups ecosystem.

By challenging entrenched norms, embracing transparency, and leveraging technology intelligently, Athena has proven that innovation can coexist with trust, regulation, and profitability. Its journey serves as a blueprint for how australia startups can disrupt legacy industries while delivering real value to consumers.

As Australia continues to position itself as a global innovation hub, companies like Athena Home Loans stand as powerful reminders that the future belongs to bold, customer-first, and purpose-driven australia startups.