In today’s fast-paced and competitive entrepreneurial landscape, business funding is one of the most critical elements for a startup’s success. Whether you’re just launching an idea or scaling an established enterprise, the ability to access capital can determine your company’s future. In India, with its thriving startup ecosystem and growing investor interest, understanding how funding works — and how to pitch effectively — is essential.

This article explores what business funding means, how it operates in India, and actionable strategies to pitch your idea successfully to investors.

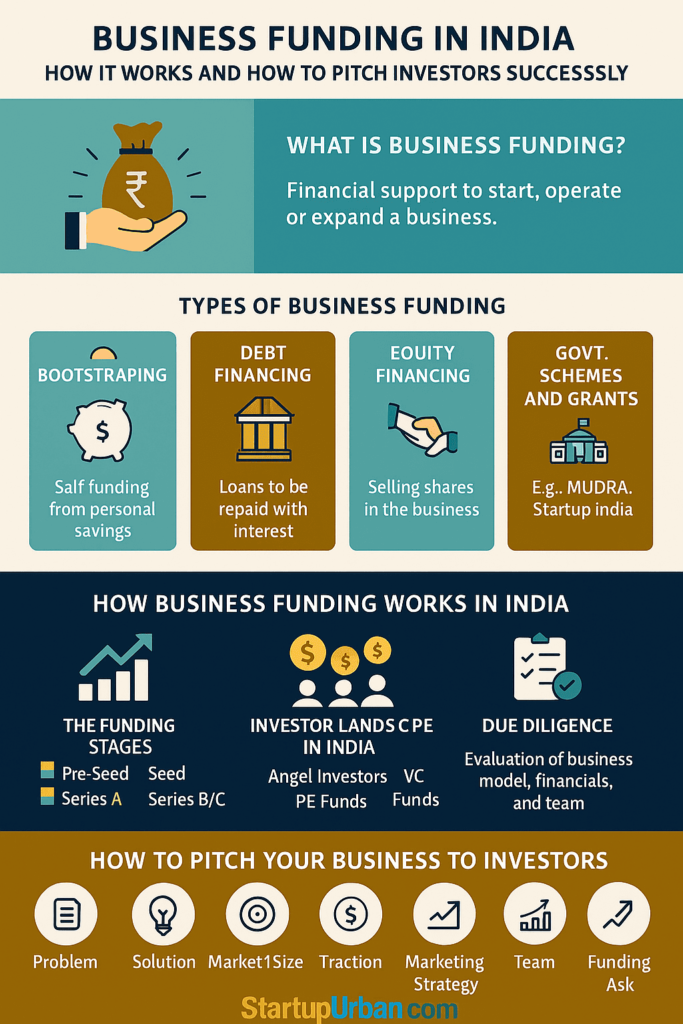

What is Business Funding?

Business funding refers to the financial support a business receives to start, operate, or expand. Funding allows a business to invest in key areas such as product development, infrastructure, staffing, marketing, and scaling.

Types of Business Funding in India

- Bootstrapping (Self-Funding)

Entrepreneurs use their own money or funds from friends and family. Common in early stages. - Debt Financing

Borrowing money (e.g., bank loans, NBFC loans) to be repaid with interest. Often preferred by businesses unwilling to dilute ownership. - Equity Financing

Investors provide capital in exchange for shares. Common sources include:- Angel investors

- Venture capital (VC) firms

- Private equity funds

- Crowdfunding

Raising small amounts from a large pool of people through online platforms like Wishberry, FuelADream, or Kickstarter. - Government Schemes and Grants

- MUDRA Loans (₹10,000–₹10 lakh)

- Startup India Seed Fund Scheme

- SIDBI Loans

These initiatives support MSMEs and innovative startups.

How Business Funding Works in India

1. The Funding Stages

Most startups in India go through multiple rounds of funding:

| Stage | Purpose | Common Investors |

|---|---|---|

| Pre-Seed | Idea validation | Founders, Friends & Family |

| Seed | Product development | Angel Investors |

| Series A | Market entry & team building | VC Firms |

| Series B/C | Scaling & expansion | Larger VC Firms, PE Funds |

| Exit | IPO or acquisition | Investment banks, public investors |

2. Investor Landscape in India

India has a robust network of investors:

- Angel Networks: Indian Angel Network, Mumbai Angels

- VC Firms: Sequoia Capital India, Blume Ventures, Accel India

- PE Firms: Blackstone, ChrysCapital

- Incubators/Accelerators: T-Hub, NASSCOM 10,000 Startups, IIT/IIM incubators

3. Due Diligence

Once an investor shows interest, they conduct due diligence, which includes reviewing financials, market strategy, legal compliance, and the founder’s background.

Business Funding Strategy Chart

| Stage | Funding Type | Sources | Strategy |

|---|---|---|---|

| Idea Stage | Bootstrapping/Seed | Self, Friends, Angel Investors | Build MVP, market research, proof of concept |

| Early Growth | Angel/VC | Angel Networks, Seed Funds | Highlight early traction & team strength |

| Expansion | VC / PE / Debt | VCs, PE Funds, Banks | Show scalability, revenue growth |

| Maturity | IPO / Strategic Exit | Public Markets, Large Corporations | Focus on profitability and governance |

| Govt. Support | Loans/Grants/Subsidies | Startup India, SIDBI, MSME Schemes | Align with national priorities (e.g., Make in India) |

How to Pitch Your Business to Investors in India

Pitching to investors is both an art and a science. You’re not just selling a product — you’re selling a vision, a strategy, and a team capable of executing that vision.

Step 1: Create a Winning Pitch Deck

A pitch deck is a visual presentation that outlines:

- The Problem: What market gap are you addressing?

- Your Solution: Product/service that solves it

- Market Size: Total and addressable market

- Business Model: Revenue generation strategy

- Traction: Users, growth rate, revenue

- Marketing Strategy: How you acquire and retain customers

- Team: Founders and key roles

- Financials: Forecasts for next 3–5 years

- Funding Ask: How much you need and how it will be used

Step 2: Know What Investors Look For

Investors in India typically assess:

- Scalability and market potential

- Product-market fit

- Unit economics and burn rate

- Founders’ expertise and passion

- Exit opportunities (acquisition/IPO)

Step 3: Tailor the Pitch

Customize your pitch based on the investor type:

- Angel Investors may focus on your passion and the innovation.

- VCs are more analytical — they’ll look at metrics and future potential.

- Banks assess repayment capacity and risk.

Step 4: Be Transparent and Data-Driven

Avoid overpromising. Investors appreciate:

- Realistic projections

- Clear customer feedback

- Risk mitigation strategies

- Well-defined milestones

Government Support for Business Funding

Here are key schemes and initiatives in India:

| Scheme | Purpose | Eligibility |

|---|---|---|

| Startup India Seed Fund Scheme (SISFS) | Financial assistance for idea-stage startups | DPIIT-recognized startups |

| MUDRA Loans | Loans up to ₹10 lakh under 3 categories | Micro and Small Enterprises |

| Stand-Up India | Loans for SC/ST and women entrepreneurs | Greenfield enterprises |

| SIDBI Schemes | Soft loans and working capital support | MSMEs |

Final Thoughts

India offers a wealth of opportunities for entrepreneurs seeking funding. From seed capital to Series C, and from angel investors to government-backed loans, the ecosystem is more supportive than ever before. But securing funding isn’t just about having a great idea — it’s about proving its worth, presenting it effectively, and showing that you are the right person to bring it to life.

If you approach funding strategically — with clarity, credibility, and confidence — you’re already one step closer to building the next big thing in India’s startup story.