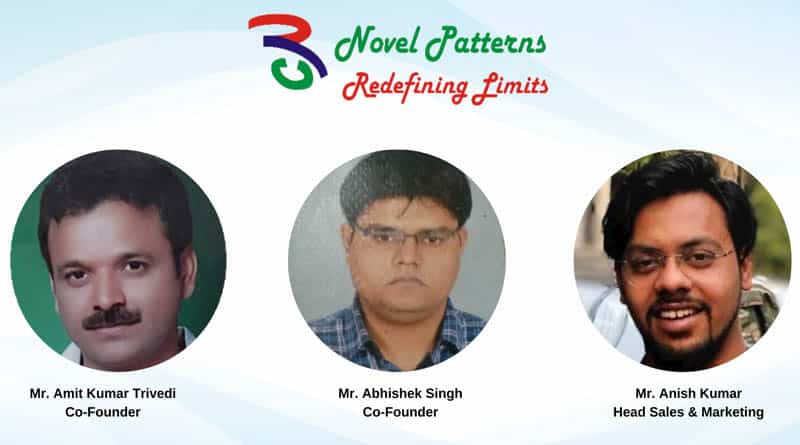

Founders – Amit Kumar Trivedi & Abhishek Singh

Website – Novel Patterns

There was a time when a home loan approval with time to cash would easily take 25–40 days. With the current advancement in technology, the overall TAT has come down drastically but is still manual intensive and involves huge operations cost. “According to Livemint article dated 27 May 2021, the average lag between the date of occurrence of frauds and their detection by banks and Financial Institutions was 23 months during 2020–21.

Realizing the gap where current industry players have solved the business problem with rudimentary tech solutions but not made big investments in underlying tech upgrade to leverage the latest stack available, Amit Trivedi and Abhishek Singh commenced operations in 2017 to leverage their combined experience of almost 35+ yrs in data science area to leverage Advance AI & ML algorithms along with Document ontology algorithms to build a use case of Bank Statement Analysis for automation of credit underwriting process of a loan lifecycle.

Novel Patterns then ventured out with a roadmap to automate complete underwriting by covering ITR and GST analysis and other income documents.

The core reasons why Novel Patterns was able to replace existing industry leaders in this space of Bank Statement Analysis is because of superior service quality, lesser rejection rates with documents, wider coverage in terms of the banks and financial institutions, very robust Fraud-detection and aggressive pricing.

Making technology solutions user-friendly and cost-effective has always been the primary aim of Novel Patterns.

Making even an Rs.1000 loan profitable is the mission statement the company and the founders started off with. During the Pandemic onset, Novel Patterns also realized the need for platforms that could help people avoid physical travel and perform onboarding and client servicing processes remotely. Hence, they set in motion the development of their video-based platform MyConCall which can be used for Video KYC, Personal Discussions, vendor empanelment and document sharing. This helped bank personnel to cover the last mile without any physical travel with all artifacts including video interaction recording, KYC documents capture, business validation rules, questionnaire responses and location stored in electronic streams and available from an audit perspective as well. The platform also helped in the overall initiative of complete digital and paperless processing of loans across all verticals.

Both the platforms for Novel Patterns have been designed from the ground up without the use of much external components as it also satiates the product enthusiasts in each of the firm’s team members. Currently heading the Sales & Marketing, Anish Kumar also comes up from a similar background of helping leading Banks across the globe streamline their asset and liability processes for almost 7+ yrs. Novel Patterns started out with its first customer in 2018 and has been on exponential revenue growth month on month since then.

Currently, serving 40+ Banks and Financials Institutions and adding value in their day-to-day processes. Almost Zero attrition rate in terms of employee retention and Customer retention, speaks volumes of the company culture and the processes being followed with every aligned person becoming part of the overall growth journey and getting the ultimate pride and gratification is looking at so many people using the platforms and able to add value through technology.

Novel Patterns acts as Strategic Partners and not just another vendor and are very open to working with leading Banks and NBFCs to configure solutions as per business requirements and not limit opportunities because of technology or platform constraints thus becoming the ideal technology partners.

In their effort to address and add value to the complete banking industry — Retail, corporate and Investment Banking, the products and the roadmap is aligned to leverage NLP and NLG tech stack for very advanced and user-friendly platforms supporting conglomerates in achieving their digital initiatives even faster and playing a major role in the exponential growth.

Exclusive Interview with Mr. Amit Kumar Trivedi

What made you strike this business idea? What inspired you to start this company?

Amit : Having had almost 2 decades of experience of consulting for banks across the globe to automate and streamline the processes, one common challenge we were up against was to make the technology user-friendly and cost-effective so that it can help the business function the way it is intended to do. We have tried to address the complete Banking space with advanced technology including and not limited to Retail, Corporate and Investment banking through our platforms.

Common areas in the lending lifecycle like assessment and automation of credit analysis during the underwriting process of a loan and video-based solutions for onboarding and servicing is something where we have added value with our platforms C.A.R.T and MyConCall respectively.

Genesis, our new-age investment management platform helps in automating Middle and back-office operations and takes the pain out of accounting and reporting needs with multiple Asset classes set up.

When did you start your business?

Amit: We had set up our principal operational office in Q3 2017.

What does success mean to your company?

Amit: Making Technology cost-effective and user-friendly is our primary goal. Technology that helps to cover the last mile and add value in the overall ecosystem of Financial Inclusion and in the end enriches the customers experience is success for us.

How are you performing currently?

Amit: We are on a very good growth trajectory with almost 7x growth in Q1 comparison from FY20 to FY21. Recent acquisitions are not only in India but we are also looking at a very good pipeline from South East Asia and Middle East as well. With Zero customer attrition, we hope to add value in the same way and keep our value system intact.

What is the biggest risk to your company?

Amit: We always try to invest in the latest technology and stay up the curve. We are hardcore Product enthusiasts who try to build platforms to ease people’s lives. With current pandemic situations at hand, we do envisage some economic risk with troubled Banking space and higher NPA rates and quality of assets.

What are your plans for the funding?

Amit: We are in discussion with multiple people as we speak but our ideology is to work with Strategic partners who can act as our investors. Dumb money as they say is no good. We need someone who can also play a major role in finding us in roads and key insights of the industry as well.

What is the biggest challenge you faced during your start-up setup?

Amit: After setting up the core team, on-boarding resources with same level of zeal and spirit to bring down the world was a little challenging for us. With time and through our circle of reference, we have been able to build on a very good team which works with ownership and unchallenged accountability.

What does growth mean to you and your business?

Amit: In growth terms, we have set to achieve a constant revenue growth of 25-30% month on month which we have been able to achieve in the last 2 Quarters. We also have been able to achieve growth in terms of customer acquisition more than 100% every 6-8 months.

How does your product stand different from others in the market?

Amit: We have actuated our complete experience of Data Science and Advance Analytics in the past as well to conceptualize and implement digital journeys and paperless processing for conglomerates across the Globe. All that combined experience of more than 50yrs+ has gone into our platforms of leveraging the most advance tech stack and still making it user-friendly and cost-effective for enterprises.

Where are your start-up services spread?

Amit: We are headquartered in Noida, U.P with customer base spread across India.

What does it feel like to be the founder of your start-up? How does it feel to get up every morning and getting on to work?

Amit: There is no better feeling than waking up every morning and wanting to get back to the desk where the magic happens. The power in our hands which helps in adding value to different organizations across has really been the motivating factor. This also adds responsibility on our shoulders to better our services so that we are able to better experiences and achieve operational excellence.

Where do you see your business standing in the next 5 years?

Amit: We always believe in the continuous process of learning and staying curious and ever-evolving with time. In the next 5 years, we wish to be ready with a complete gamut of products adding value across the entire ecosystem. Global expansion has also been on our charts, the foundation of the same and working out the groundwork for specific geographies have already been laid out.

Who supports you to stand this business and how?

Amit: Friends and family have been a constant support and believing in us that we can change the normal and make excellence make normal and a habit for everyone.