Divido is one among the different startups set up in the UK. With an intention to offer a flexible and convenient mode of operation at the point of sale finance sector, Divido began its operations in the year 2016. The cloud-based service ensures covers lenders, customers, and retailers. Divido works in three different modes – online, by phone, or at the store. A major attraction about the startup company is the mouth-watering ability it provides to the customers in retail finance, automobile finance, and SME loans. It even supports multiple languages and currencies!

How Divido evolved?

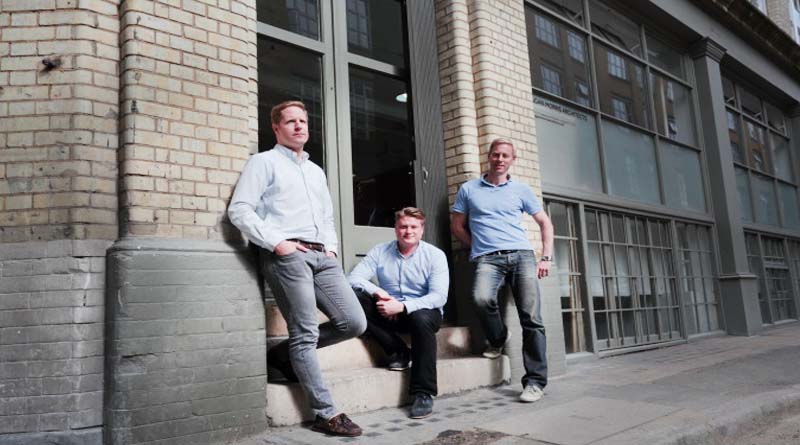

Christer Holloman, CTO of Divido, came across a store in his neighborhood that was unable to offer the same installment plan as that of a big retail chain outlet. Together, with the help of Fredrick Borquist, and Anders Hallsten, Holloman saw the birth of Divido. Using this platform, a consumer possesses the ability to make payment for purchase anywhere between five months to five years.

Seed Funding

As a startup, Divido required funds, and therefore, opted for seed funding, where it did raise £2.5 million, thanks to the help offered by DN Capital and Mangrove Capital. However, the funding is the second for the company, as it already received funding from the government of UK under the Innovate UK policy with a grant of £2 million. It won the award for providing transparency in point of sale finance sector.

How does it operate?

At the point of sale, a consumer has the option to choose for Divido for completing the payment. The platform will ask to either delay the payment or split into multiple payments over a maximum period of five years for high priced products. However, unlike the traditional payment option, the platform connects the customer directly with the lender who competes to offer the best pricing structure and interest rate based on the client’s credit score.

According to Holloman, Divido is a single marketplace from the point of sale lenders and a one-time payment method, which is helping the competitive field of lenders to some extent. Putting it in the American language, the platform is creating a democratic space for consumers, retailers, and lenders as well. The operational activity by the company also helps in understanding the way it runs its business, as there is no liquidity provided by Divido. Marketing, operations and product development utilizes whatever the investment the company receives in the form of funding.

The new seed funding for the company will be a significant boost, as it will help it grow bigger and expand its operation to different retailers and lenders. In case, if you are wondering about the salaries of employees at Divido, then every time a retailer completes a sale, they share a particular percentage of the payment when the action is through Divido platform. As the retailer receives the money upfront, the company will not worry about not receiving the money from the customer. At the same time, a customer too can move ahead by choosing the right repayment option, which remains the same across small or big retailers.