Slice, a company focused on providing Visa cards to millennial demography has recently been inducted into the exclusive Unicorn Club. It raised $220 Million in a Series B funding round led by United States investment giant Tiger Global and New-York-based private equity and venture capital firm Insight Partners, the latter also being first-time investors in Slice. This round also saw participation from Flipkart’s co-founder and ex-CEO Binny Bansal and London-based payment platform checkout.com founder Guillaume Pousaz. This excellent league of investors has resulted in Slice’s value surpassing one billion dollars and becoming a unicorn company. A Unicorn company is any privately owned entity that has a value of one billion dollars or more.

Because this year most members of the Unicorn club were companies that had a financial technology background, it wasn’t surprising to see Slice become the 41st company to achieve this feat in 2021. Slice focuses on providing visa cards to millennials and allows customers to pay for their purchases in three installments. The number of the company’s card issuers saw a substantial leap from 20,000 in January of this year to 200,000 per month currently. This spike can be attributed to the growing trend of using credit among the youth in India.

Slice ‘super card’ serves as a preferable alternative compared to normal credit cards due to its lower credit limit, making more people eligible to issue the card and be able to pay later when feasible. The company’s monthly issuance is now at par with leading banks like HDFC Bank and ICICI bank which lie somewhere between the range of 2,00,000 to 3,00,000.

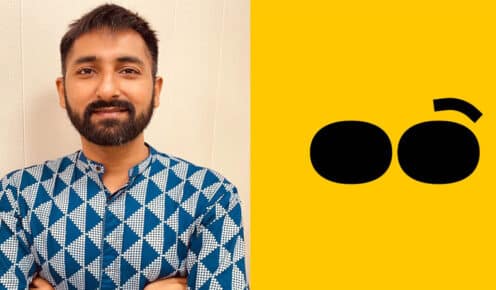

The company’s revenue for the Financial Year of 2021 stood at ₹35 crores as compared to ₹30 crores in the previous Financial Year. In an interview with Moneycontrol, Slice founder Rajan Bajaj shared his insights regarding Slice future. According to him, Slice is planning to invest in technology and product design and add Unified Payments Interface (UPI). Due to a rapidly rising revenue, Bajaj believes that new as well as old customers will start using UPI for their payments on Slice’s platform.

Slice’s current growth rate is forty percent per month. It is expected that this growth will keep on continuing. Slice will find itself competing with other established fintech and banking moguls. But with a continued focus on market growth and product diversification, Slice has a promising future ahead of it.

Credit To – Prashansa Parwal